You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Trump Presidency

- Thread starter The Tariff King

- Start date

chop2chip

Well-known member

Now the fight over tax reform begins. https://apnews.com/f609602269d54524aa14e1d9c74ec97c

Some details:

1. Double the standard deduction to $24,000 per couple/$12,000 per individual

2. Cut corporate rate from 35% to 20%

3. Reduce tax brackets from 7 to 3

4. Leaves intact mortgage interest and charitable donation deductions

5. Increases bottom tax rate from 10% to 12%

Sen. Chuck Schumer says Trump’s plan only gives “crumbs” to the middle class, while top-bracket earners making more than a half-million dollars a year would reap a windfall.

The New York Democrat also blasted the plan for actually increasing the bottom tax rate from 10 percent to 12 percent, calling it a “punch to the gut of working Americans.”

Schumer said the plan is little more than an “across-the-board tax cut for America’s millionaires and billionaires.”

President Donald Trump has two red lines that he refuses to cross on overhauling taxes: the corporate rate must be cut to 20 percent and the savings must go to the middle class.

Gary Cohn, the president’s top economics aide, says any overhaul signed by the president needs to include these two elements.

Trump had initially pushed for cutting the 39.6 percent corporate tax rate to 15 percent.

The administration says that the benefits of any tax cut will not favor the wealthy, with Cohn saying that an additional tax bracket could be added to levy taxes on the top one percent of earners if needed.

Starting from the top, I like 1-3. Higher standard deductions are the lowest hanging fruit when you want to provide a greater positive impact on low income families. The lower corporate tax rate is easily politicized, but easily understood thanks to corporations like Apple keeping massive amounts of cash offshore. Repatriation of that money, and of entire corporations, would go a long way toward helping the economy and increasing our tax revenue. Fewer tax brackets simplifies the tax code, always a good thing. This is also the most likely place to game tax cuts for those whodonate to campaignsearn the most, so it will deserve the most scrutiny.

Increasing the bottom tax rate from 10%-12%? What are they thinking here? Yes, it's obvious to anyone with multiple brain cells that the people in the bottom tax rate will still benefit from this plan overall, thanks to the doubled deduction. It should also be obvious that this increase will be painted in the worst possible light when the story runs on the nightly news and Twitter feeds.

My hope is that this is a placeholder, thrown in to allow Schumer to negotiate it away. The failure to include the extra bracket for the top 1% in the initial plan falls into the same category. That hope seems ridiculously optimistic.

Apple has their international principals in Ireland and Singapore - safe, legal, and protected. If you think they are restructuring and repatriating that income then I have some beach front property to sell them you in Cork.

goldfly

<B>if my thought dreams could be seen</B>

this idiot still going on about the anthem and his little fascists fall in line to cry and moan cause they think it's an attack on their military fetishism

not standing for the anthem if you don't want to for whatever reason is exactly why this country is great

not standing for the anthem if you don't want to for whatever reason is exactly why this country is great

I bet this will give thethe and krg their biggest boners yet.

https://gizmodo.com/us-homeland-security-will-start-collecting-social-media-1818777094

https://gizmodo.com/us-homeland-security-will-start-collecting-social-media-1818777094

sturg33

I

this idiot still going on about the anthem and his little fascists fall in line to cry and moan cause they think it's an attack on their military fetishism

not standing for the anthem if you don't want to for whatever reason is exactly why this country is great

I agree.

But you don't seem to apply this same logic to the confederate flag.

Weird

jpx7

Very Flirtatious, but Doubts What Love Is.

http://www.postandcourier.com/polit...cle_3bcc9c02-a390-11e7-a07a-4f198203bb3e.html

U.S. Sen. Tim Scott, the Senate's lone black Republican, said Wednesday that NFL players should not protest during the national anthem.

"I think every man, woman, child should stand for the national anthem. That should go without question," the South Carolina senator told CNBC.

Though Scott said he did not agree with the form of protest, he urged people to think about the deeper issues behind the act itself by asking a simple question.

"We should also ask ourselves the question: Why are they kneeling?" Scott said. "If we were able to reinforce the fact that we all should stand and delve into the challenges that have some players kneeling, we'll be in a better place as a country."

Nothing should go without question.

I agree.

But you don't seem to apply this same logic to the confederate flag.

Weird

Or free speech

chop2chip

Well-known member

The best part of this anthem controversy is that basically everybody agrees on these two points.

1. The flag and what it symbolizes should be respected

2. Freedom of expression should be protected

Why we are still fighting about this baffles me. If the media and trump stopped putting wood on this fire it would burn out so quickly.

1. The flag and what it symbolizes should be respected

2. Freedom of expression should be protected

Why we are still fighting about this baffles me. If the media and trump stopped putting wood on this fire it would burn out so quickly.

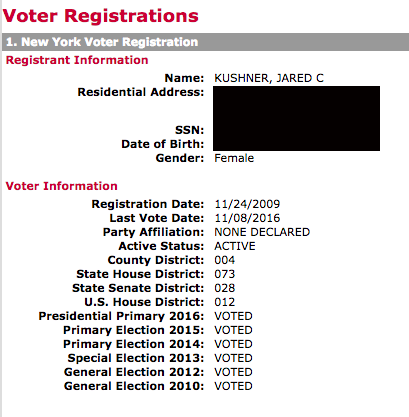

Report that Kushner voted as a woman.

Jaw

It's OVER 5,000!

I bet this will give thethe and krg their biggest boners yet.

https://gizmodo.com/us-homeland-security-will-start-collecting-social-media-1818777094

(5) expand the categories of records to include the following: country of nationality; country of residence; the USCIS Online Account Number; social media handles, aliases, associated identifiable information, and search results; and the Department of Justice (DOJ), Executive Office for Immigration Review and Board of Immigration Appeals proceedings information

[...]

(11) update record source categories to include publicly available information obtained from the internet, public records, public institutions, interviewees, commercial data providers, and information obtained and disclosed pursuant to information sharing agreements;

I read this first and thought, "Yeah, they're illegal immigrants. Track 'em."

It's not illegal immigrants. It's all immigrants. Even naturalized citizens. While everyone is arguing about flags and football fields, Big Brother slips this in. This is insanity.

(5) expand the categories of records to include the following: country of nationality; country of residence; the USCIS Online Account Number; social media handles, aliases, associated identifiable information, and search results; and the Department of Justice (DOJ), Executive Office for Immigration Review and Board of Immigration Appeals proceedings information

[...]

(11) update record source categories to include publicly available information obtained from the internet, public records, public institutions, interviewees, commercial data providers, and information obtained and disclosed pursuant to information sharing agreements;

I read this first and thought, "Yeah, they're illegal immigrants. Track 'em."

It's not illegal immigrants. It's all immigrants. Even naturalized citizens. While everyone is arguing about flags and football fields, Big Brother slips this in. This is insanity.

Exactly why I said thethe and especially krg would have big boners.

(5) expand the categories of records to include the following: country of nationality; country of residence; the USCIS Online Account Number; social media handles, aliases, associated identifiable information, and search results; and the Department of Justice (DOJ), Executive Office for Immigration Review and Board of Immigration Appeals proceedings information

[...]

(11) update record source categories to include publicly available information obtained from the internet, public records, public institutions, interviewees, commercial data providers, and information obtained and disclosed pursuant to information sharing agreements;

I read this first and thought, "Yeah, they're illegal immigrants. Track 'em."

It's not illegal immigrants. It's all immigrants. Even naturalized citizens. While everyone is arguing about flags and football fields, Big Brother slips this in. This is insanity.

The government knows all of this about you and I.

Their having the knowledge is a long step from codifying their right to have the knowledge.

My point Is if the government knows everything about you and i, what’s the big deal with the government knowing everything about immigrants too?

Jaw

It's OVER 5,000!

I think the government has given themselves enough access to what should be private information over the last 16 years.

I don't think it is okay when more privacy is taken from any law abiding citizens of this country.

In an effort to take away the ability of jihadis to terrorize us, we keep giving our government more of that ability. These guys should have better things to do than find out what Julio Teheran's snapchat name is.

I don't think it is okay when more privacy is taken from any law abiding citizens of this country.

In an effort to take away the ability of jihadis to terrorize us, we keep giving our government more of that ability. These guys should have better things to do than find out what Julio Teheran's snapchat name is.