sturg33

I

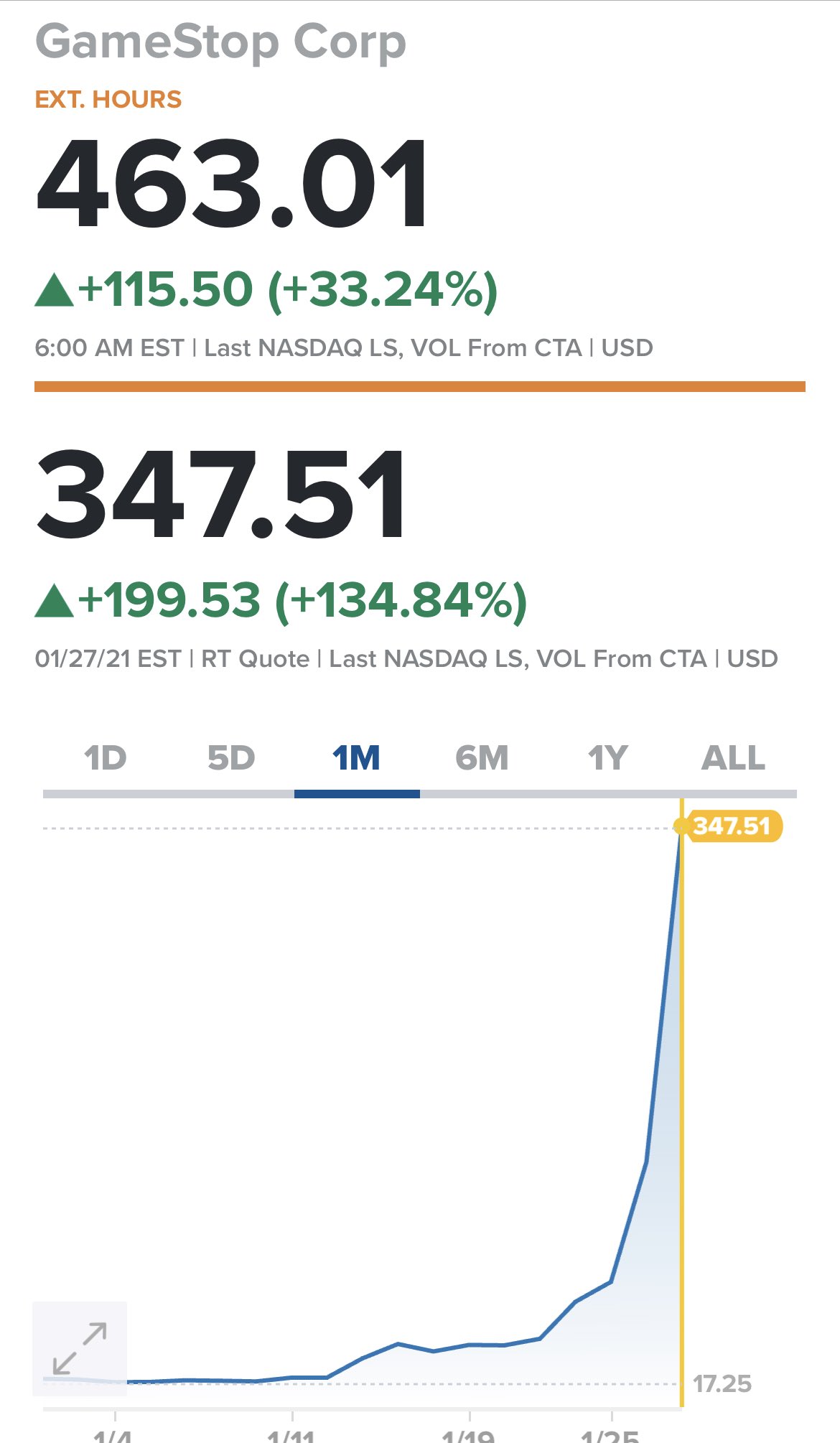

I have $100 in Gamestop right now. More to just be a part of the movement against the hedge funds. Fight back against them rigging the system. I'm not comfortable putting real money in that high risk.

I put $5k in NOK this morning purely as a middle finger.

So far so good... I got in around $5.60. Will plan to exited around $10. The momentum should get us there but if not, its money I'm willing to lose