sturg33

I

Re-posting this for fun

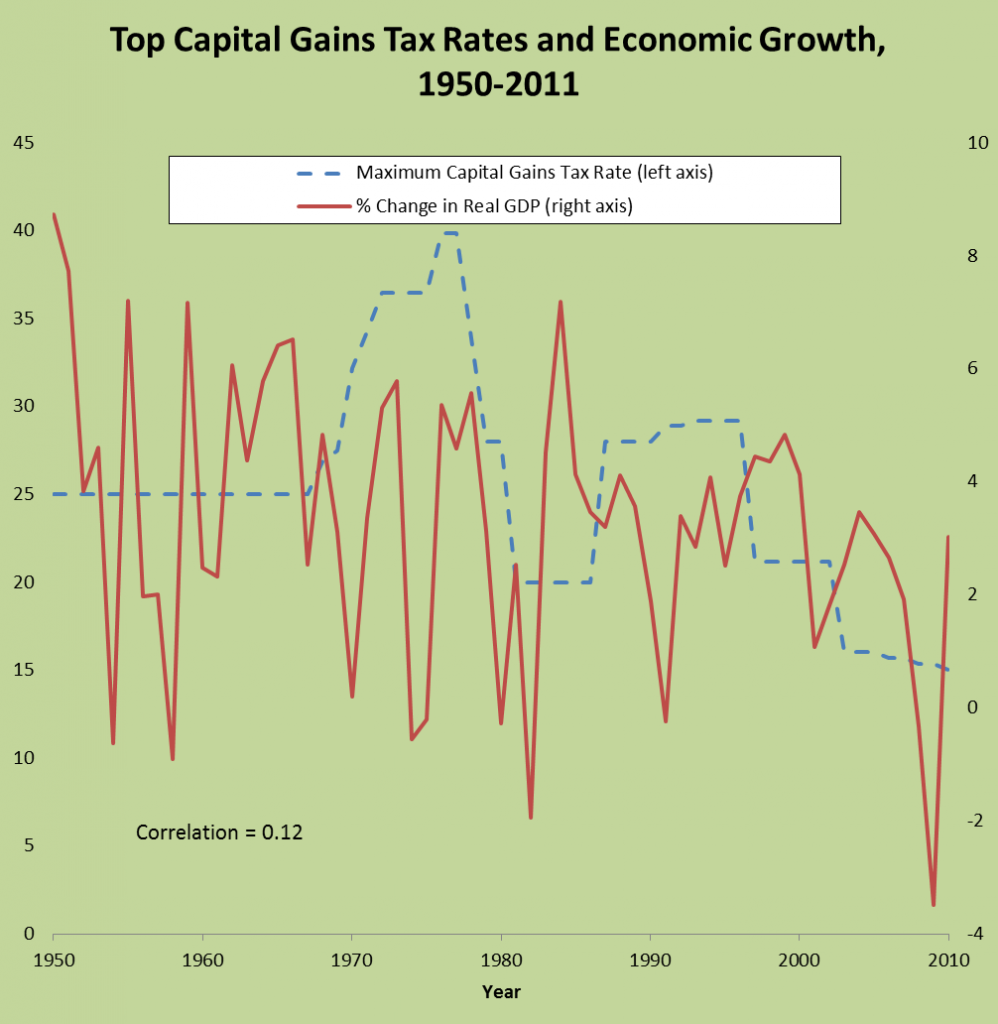

The one time the capital gains tax rate was increased since 1981 was in 1987, from 20% to 28%. From 1987-90, capital gains revenue fell from $33.7 billion to $27.8 billion, with an average annual decline of -12.8%.

Capital gains tax rates were cut from 28% to 20% in 1981, again from 28% to 20% in 1997, and from 20% to 15% in 2003. Capital gains tax revenues grew by an annual average of 15.8% from 1981-84, 17.8% from 1997-2000, and 25.5% from 2003-06.

But hey, then it wouldn't be fair.

"Should" is a moral term in this case. "The wealthiest Americans should pay a higher rate" is a moral statement, expressing a moral standard. Not saying it is wrong. But let's not think it is morally neutral.

I think that the investor class is the problem with the economy now. Yes. Not all of them of course. But all the investor class is out there to do is to make money on the backs of other companies. And then ditch those companies.

For example, Carl Icahn wants Apple to buyback a healthy chunk of their stock, the only people that benefits are the people with tons of stock in Apple. Doesn't help Apple or their employees, just the richest. If Apple took their cash and invested it in the company that benefits Apple and their employees it works out for everyone but the evestros. That's what needs to happen, not the foolish stock buy back that's what ultimately led Blackberry to their doom.

Typically, companies will have treasury stock that are used for these employee plans.

Correct, but what was happening with Apple from what I understand was the stock giveouts were happening too much for the investors or something along those lines and so to appease them Apple started their buyback.

I don't know anything about that but normally the #1 reason for a stock buyback is if the company believes its stock is undervalued. It sends a positive message to the market that the company is confident moving forward.