You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

First Former President to Have His Taxes Revealed Under Duress

- Thread starter 57Brave

- Start date

sturg33

I

Nancy Costa Hall

@NancyCo39783233

·

17h

Replying to

@MeidasTouch

I’d love to know how he paid $750 two years in a row. My husband

and I pay more than that living on his SS, Pension, and starting last

month my SS. He has great pension and SS but we’re not rich

and we pay more? Make it make sense.

I don't expect very stupid people to understand our very complicated tax code

Tapate50

Well-known member

I don't expect very stupid people to understand our very complicated tax code

Right? Just say you don't know how it works instead of griping about it.

For example this year you can depreciate a work vehicle 100% in one year as a deduction.

I was not aware of it, so i didn't take advantage.

That is my fault, not the tax codes. So you won't see me tweeting about how it doesn't make sense.

sturg33

I

Right? Just say you don't know how it works instead of griping about it.

For example this year you can depreciate a work vehicle 100% in one year as a deduction.

I was not aware of it, so i didn't take advantage.

That is my fault, not the tax codes. So you won't see me tweeting about how it doesn't make sense.

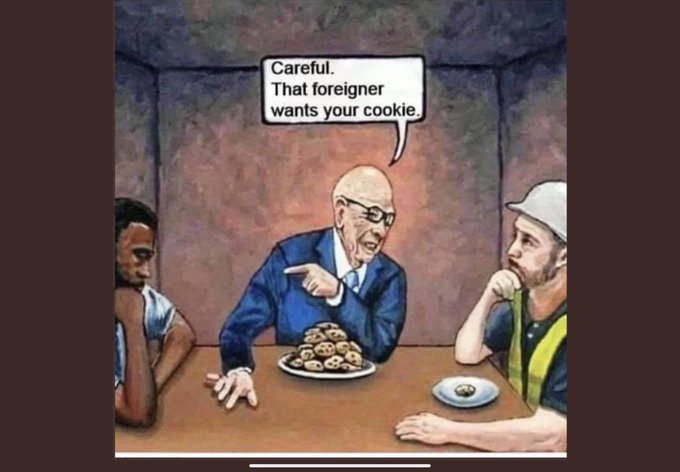

Well, I think people have a right to complain about the tax code. It's impossibly complicated and for very good reason... It helps the rich and it hurts the non rich.

Trump even called this out in a debate against Hilary. Told her she would never change it because it would hurt her rich donors.

Pretty profound.

57Brave

Well-known member

Well, I think people have a right to complain about the tax code. It's impossibly complicated and for very good reason... It helps the rich and it hurts the non rich.

Trump even called this out in a debate against Hilary. Told her she would never change it because it would hurt her rich donors.

Pretty profound.

who complained about the tax code ---

I merely pointed out sturg voted for a tax fraud

because he gave him a $4000 tax credit (not to dismiss-

while giving a patronizing wink and a nod to racism and

the "pro" life faction of (R).)

Big difference between someone that can make the tax code work for them

and someone caught cheating.

Big difference

57Brave

Well-known member

Eric

@erictheday

·

50m

Replying to

@Acyn

So many people in the comments don't understand the issue:

The IRS doesn't need a president to "release" their taxes for the

mandatory audit. The IRS already has the tax returns. The issue is that

Trump seems to have ordered the IRS to skip the audit while

he was president.

like I said above, big difference

@erictheday

·

50m

Replying to

@Acyn

So many people in the comments don't understand the issue:

The IRS doesn't need a president to "release" their taxes for the

mandatory audit. The IRS already has the tax returns. The issue is that

Trump seems to have ordered the IRS to skip the audit while

he was president.

like I said above, big difference

57Brave

Well-known member

The releasing of the taxes to the public is a courtesy to the voters. Not (yet) mandatory

If memory serves Trump did promise a time or two that he would release them to the public

but used the "audit" as an excuse.

Alas, he not only was, as suspected, never going to voluntarily release the returns to the public as promised, but rigged the system to avoid the audit

He lied about

that's y'alls boy

If memory serves Trump did promise a time or two that he would release them to the public

but used the "audit" as an excuse.

Alas, he not only was, as suspected, never going to voluntarily release the returns to the public as promised, but rigged the system to avoid the audit

He lied about

that's y'alls boy

sturg33

I

who complained about the tax code ---

I merely pointed out sturg voted for a tax fraud

because he gave him a $4000 tax credit (not to dismiss-

while giving a patronizing wink and a nod to racism and

the "pro" life faction of (R).)

Big difference between someone that can make the tax code work for them

and someone caught cheating.

Big difference

Actually you posted a tweet from some lady not understanding why he paid what he paid, and demanded to make sense of it

That you or her do not understand the tax code is not surprising but I wouldn't flaunt my ignorance if I were you

Tapate50

Well-known member

who complained about the tax code ---

I merely pointed out sturg voted for a tax fraud

because he gave him a $4000 tax credit (not to dismiss-

while giving a patronizing wink and a nod to racism and

the "pro" life faction of (R).)

Big difference between someone that can make the tax code work for them

and someone caught cheating.

Big difference

The tweet you thought enough of to go find and post here LITERALLY is saying that they don’t understand

Lol

sturg33

I

take a shot, "make sense of it"

tax codes have been complicated and a maze for --- forever

you can start here

so go ahead, help the lady out, make sense of $750 --- 2 years in a row.

,

--- $750 Not $749.50 or $800

She can hire an accountant to go through the tax returns of a stranger and make sense of it. I do not care at all and thus won't invest the time to look at it

57Brave

Well-known member

Nancy Costa Hall

@NancyCo39783233

·

17h

Replying to

@MeidasTouch

I’d love to know how he paid $750 two years in a row. My husband

and I pay more than that living on his SS, Pension, and starting last

month my SS. He has great pension and SS but we’re not rich

and we pay more? Make it make sense.

go ahead, make it make sense

answer the lady's question

//////////////

in this case, it really doesn't require much time investment

Last edited:

sturg33

I

make it make sense big boy

It is not my job to educate idiots and humor their weird obsessions.

If he committed a tax crime, I'm sure he will face charges for it