You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Trump Presidency

- Thread starter The Tariff King

- Start date

57Brave

Well-known member

Please leave the economics talk to the adults

This is not about economics. It is about freedom

Gimme some of that good ol trickle down ...

or what they call in Puerto Rico "fend for yourself"

57Brave

Well-known member

Please leave the economics talk to the adults

Sen. McCaskill (D-Missouri) said it was odd that repealing a tax would actually increase and not decrease government revenue.

“Where do you think the 300 billion dollars is coming from? Is there a fairy that’s dropping it on the Senate,” Sen. McCaskill asked.

McCaskill says the $300 billion would be coming from decreases in healthcare subsidies and Medicaid costs.

“If you’re getting rid of a tax how does miraculously $320 billion dollars show up for you to spend on corporations? I’ll tell you why, because you’re eliminating $185 billion dollars in payments of subsidies to people who are getting insurance,” said Sen. McCaskill.

Senate Finance Committee Chair Orrin Hatch (R-UT) continued to debate with Sen. McCaskill about the benefits of the modified tax reform bill.

“If you’ll yield. If you would just yield for a second, there are no cuts to Medicaid in this bill,” said Hatch.

“The money you’re spending is coming from Medicaid and subsidies to people who make less than $50,000,” Sen. McCaskill said.

Seems like it's actually a pretty banal take (no offense, Julio). The blanket sales tax is a good example of a regressive tax that "poor people" pay, and which is actually more burdensome the poorer you are. And it's why you find a lot of people otherwise comfortable with taxation, like myself, who are against blanket sales taxation—though I do personally support targeted sales (and/or excise) taxes on "luxury" items.

One positive thing I can say about sales tax is that it does have an element of universality underpinning it (in a way that the federal income tax does not). Anyways, don't get me started on taxes - I just moved to San Francisco.

57Brave

Well-known member

Please leave the economics talk to the adults

George Monroe @Nupe117

7h7 hours ago

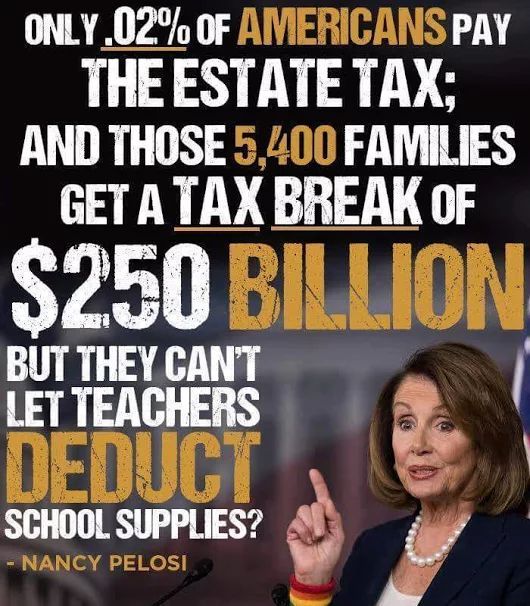

Giving trillions away to fat cats, but cutting a $250 exemption teachers can take for buying their students pens, pencils and papers. What the **** is wrong with America @cspanwj

jpx7

Very Flirtatious, but Doubts What Love Is.

The insane proposal to tax graduate students for the amount of the tuition that is waived by their University—as opposed to simply their research stipends and teaching earnings (for which they are already taxed)—would increase taxes for graduate students by 300-400% and "make it financially impossible to earn a Ph.D. in the United States."

chop2chip

Well-known member

One positive thing I can say about sales tax is that it does have an element of universality underpinning it (in a way that the federal income tax does not). Anyways, don't get me started on taxes - I just moved to San Francisco.

Congrats on the move West. SF is great city notwithstanding its tendency for patting itself on the back for changing the world.

I have been in the Bay for three years and as much as I have to roll my eyes, it’s an easy place to learn to love.

chop2chip

Well-known member

The insane proposal to tax graduate students for the amount of the tuition that is waived by their University—as opposed to simply their research stipends and teaching earnings (for which they are already taxed)—would increase taxes for graduate students by 300-400% and "make it financially impossible to earn a Ph.D. in the United States."

Supposedly these measures are first on the Senate chopping block... and thank god because it strikes me as enormously shortsighted.

Interesting how the Franken story overshadowed the news this morning that Trump is only worth 1/10 of what he actually claimed.

Jaw

It's OVER 5,000!

The insane proposal to tax graduate students for the amount of the tuition that is waived by their University—as opposed to simply their research stipends and teaching earnings (for which they are already taxed)—would increase taxes for graduate students by 300-400% and "make it financially impossible to earn a Ph.D. in the United States."

All these good reasons aside, it's just politically stupid. Why put an obvious bull's eye like this on the bill when the amount of money involved doesn't even move the needle when it comes to fiscal impact?

Jaw

It's OVER 5,000!

Interesting how the Franken story overshadowed the news this morning that Trump is only worth 1/10 of what he actually claimed.

I wonder about his business strategy going forward. His biggest asset over the past few years has been his licensing of the Trump brand. He must have realized that running for and winning the Presidency in a polarized country would have a negative impact on the value of that brand.

He's spoken against Globalism for thirty years, and flirted with a Presidential run for 30 years. Is it possible he really believed (I'm being serious) that the country needed him that badly?

He must have realized that running for and winning the Presidency in a polarized country would have a negative impact on the value of that brand.

He's spoken against Globalism for thirty years, and flirted with a Presidential run for 30 years. Is it possible he really believed (I'm being serious) that the country needed him that badly?

You give him too much credit.

How can trump talk about Franken when he's assaulted far more women? Are we just pretending these never happened?

He's also been awfully quiet on Roy Moore. I can't figure out the difference between Franken and Moore. Hmm.

So who has Trump sexually assaulted? I couldn’t stand Obama but I didn’t go around and accuse him of horrible things Like sexual assault

nsacpi

Expects Yuge Games

So who has Trump sexually assaulted? I couldn’t stand Obama but I didn’t go around and accuse him of horrible things Like sexual assault

http://abcnews.go.com/Politics/wome...ppropriately-new-york-times/story?id=42766847

57Brave

Well-known member

Please leave the economics talk to the adults

http://nymag.com/daily/intelligence...he-gop-agenda-now-its-electing-democrats.html

Oklahoma was a low-tax state even before the 2010 GOP wave crashed over it. But tea-party Republican governor Mary Fallin and her conservative allies weren’t content with the low baseline they’d inherited. Like President Trump and congressional Republicans, Fallin believed that cutting taxes on wealthy individuals and businesses was the way to grow an economy, no matter what level those taxes were currently at, or how novel circumstances might change the government’s budgetary needs.